Properly Completing IRS Form W-9 for Your IRA/LLC or Checkbook Control IRA

June 01, 2021

Many self-directed IRA investors use an IRA/LLC (aka “checkbook-controlled IRA”) to hold their self-directed IRA investments. For an overview, see my video here. When using the IRA/LLC structure, the name of the LLC is on the title to the assets, and the LLC’s bank account receives the income. As a result of this structure, the self-directed IRA owner may be asked by a title company, property management company, or other third parties to complete an IRS Form W-9 form for the IRA/LLC. Form W-9 is the document these parties request in order to issue 1099’s for rental income or for sale proceeds for real estate, stock, or other assets sold by the LLC. Form W-9 can be tricky and needs to be handled differently when you have a single-member IRA/LLC (i.e. when the IRA owns the LLC 100%) than when the LLC has two or more owners (aka “partnership”). It is important that the W-9 is completed properly so that the IRS does not confuse whether the LLC is owned by the IRA or by the IRA owner personally.

Single-Member IRA/LLC

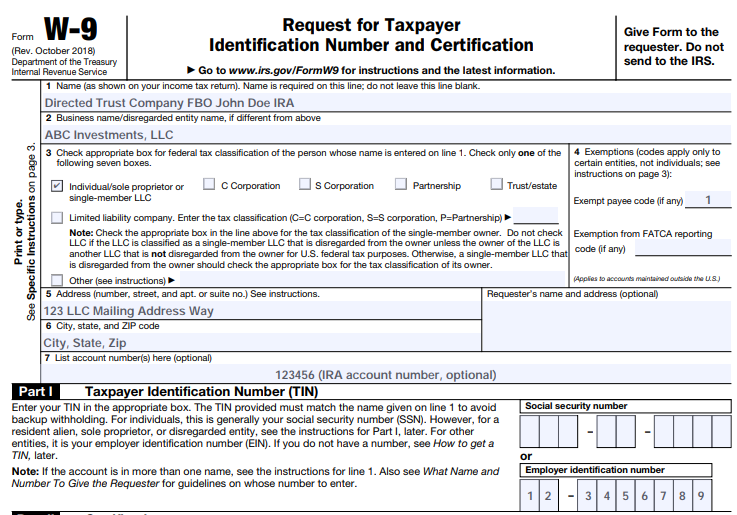

The W-9 can be tricky to complete in the single-member IRA/LLC situation. Many IRA owners will include the LLC EIN in Part I of the form or will provide the owner’s SSN. Both of those answers are incorrect. I have provided a sample W-9 form for “ABC Investments, LLC” below:

Let’s go through each line to explain the responses. I’ll start on line 1.

- Name: In the instance of a single-member IRA/LLC, the IRS considers the LLC to be disregarded, which means that the LLC is not a separate taxable entity and instead the tax reporting goes directly to the owner. In this instance, the owner of the LLC is the IRA. Consequently, the name on line 1 should be the name of your IRA. If you have a self-directed IRA with our company, that name would be something like, “Directed Trust Company FBO John Doe IRA.”

- Business Name: Line 2 is where you will list the name of the LLC. So, for example, if your IRA/LLC is called “ABC Investments, LLC,” then you would provide that name on line 2.

- Tax Classification Box: This is the section that causes confusion and often results in incorrect selections. In this section, you would check the first box, “Individual/sole proprietor, single-member LLC.” When the IRA owns the LLC 100%, the LLC is considered a single-member LLC.

- Exemptions: IRA/LLCs and IRAs are an exempt payee, and as a result, you should include Code 1 on the first blank space on line 4. See line 4 instruction on Code 1 for more details.

- Address: On line 5 and 6 you will include the mailing address for the LLC. Do not include your IRA custodian’s address as any 1099s for the IRA will be sent to the IRA custodian’s address. While most 1099s and tax reporting forms generated from a W-9 do not result in a reporting or tax obligation for the IRA, it is best that the IRA owner, who is responsible for the account and decisions, receive the 1099s at their address.

- Address (Cont’d): See line 5 response information above.

- List Account Number (Optional): You may include the IRA account number with your IRA custodian on line 7, but this is optional and is not required. If you have multiple IRAs with the same custodian, it would be helpful to also provide your account number for the specific accounts involved. Otherwise, if needed, the IRA is identifiable by the name line 1.

Part I

The next section is called Part I, and is the section where a social security number or employer identification number is used. This section is often completed incorrectly. The correct response is the EIN of the party on Line 1. In this instance, Line 1 is the IRA. Most IRAs should not have their own EIN, and you should not obtain an EIN for the purpose of a W-9. You may have an EIN for your IRA because you have Unrelated Business Income Tax (UBIT) for your IRA (which is less common). However, most self-directed IRA custodians do not have an EIN for their IRA. Instead, what you should use is the reporting EIN of your IRA custodian. All IRA custodians have an EIN that is used for their customer accounts, and this EIN can be obtained by contacting your IRA custodian.

Most IRA/LLC owners have an EIN for their LLC and some will use that EIN in Part I. While that is the correct response in the multi-member IRA/LLC (“partnership”) context, it is not the correct response for the single-member IRA/LLC. Another incorrect response on Part I is to use the social security number of the IRA owner. This is also incorrect as you do not personally own the LLC. An incorrect response on Part I doesn’t cause a prohibited transaction or disqualify the IRA, but it could create tax reporting confusions with the IRS.

Finally, the manager of the LLC would sign on Part II.

Multi-Member IRA/LLC

If your IRA/LLC has more than one owner, it is considered a multi-member IRA/LLC. Most multi-member IRA/LLCs are taxed as partnerships and as a result, the W-9 for a multi-member IRA/LLC is different from the single-member IRA/LLC.

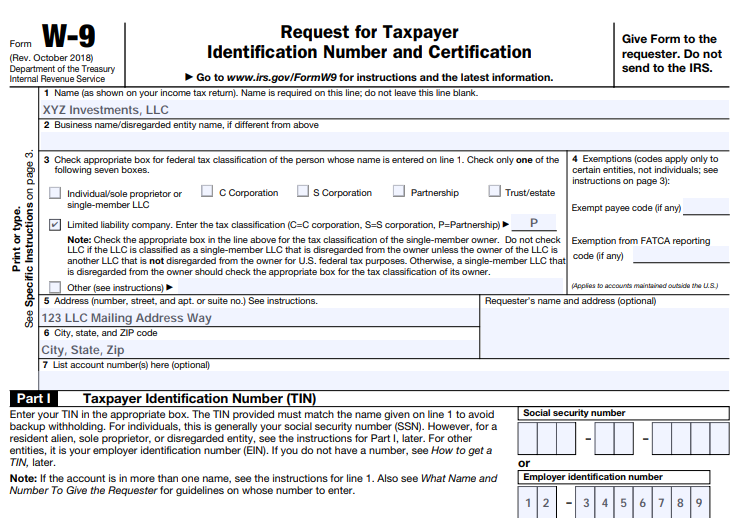

The multi-member IRA/LLC is far more straightforward. I have provided a sample W-9 below. The important items for the W-9 in this instance are as follows:

- Line 1 is the name of the LLC: In a multi-member IRA/LLC, the entity files a tax return and is recognized at the LLC level by the IRS.

- Line 2 is blank as line 1 is the LLC name and they are the same.

- Check the box limited liability company and then indicate the letter “P” for partnership.

- Skip the exemption code since the LLC itself has its own tax status (partnership usually). Even though it may be owned by IRAs the exemption doesn’t apply at the LLC level.

- Include the LLC mailing address.

- Continued mailing address.

- There is no need to list the account numbers of the IRAs here as the taxable entity itself is the LLC – not the IRAs – and there isn’t an account number for the LLC.

Part I

The LLC’s EIN should be used and provided in the box for the employer identification number. Since a multi-member LLC is taxable itself as an entity (partnership return), it provides its own EIN for reporting uses on the W-9. The IRA custodian’s EIN is not used in this instance.